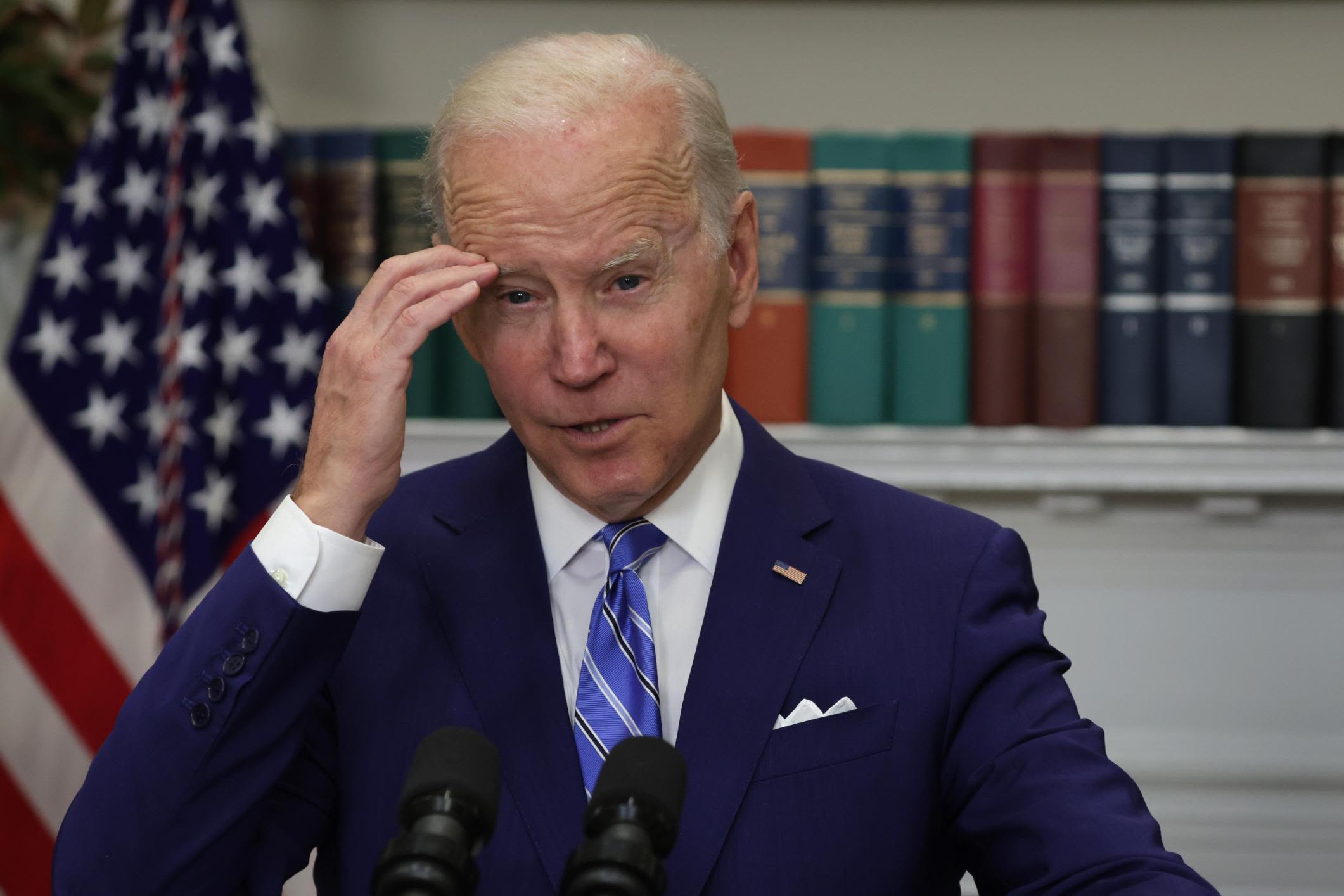

Biden Crime Family

FBI Knew in 2016 of Hunter Biden’s $120 Million Deal with Burisma Owner While Joe was VP

Published

1 year agoon

The FBI discovered in as early as 2016 that Hunter Biden and his associates planned to establish a new venture in tax-friendly Liechtenstein, backed by a substantial $120 million investment from the contentious owner of Ukrainian energy firm Burisma Holdings. This revelation comes from documents obtained by Just the News, which were withheld from public knowledge for eight years.

The significant deal was not mentioned in Hunter Biden’s notorious laptop nor during the 2019 impeachment proceedings involving Ukraine. Instead, it was detailed in a collection of 3.39 million documents seized by the FBI from Hunter Biden and his business partners during a securities fraud investigation nearly a decade ago.

Former Hunter Biden business partner Devon Archer recently handed over this cache of documents to the House Oversight Committee as part of its impeachment inquiry into President Joe Biden’s conduct.

The new evidence indicates that this major investment plan was being developed while Hunter Biden was on Burisma’s board of directors and Joe Biden was vice president, overseeing U.S.-Ukraine policy under Barack Obama.

Memos reveal that Hunter Biden was expected to join the board of a new company named Burnham Energy Security LLC, which Burisma owner Mykola Zlochevsky intended to capitalize in 2015. At the time, Zlochevsky was trying to escape corruption allegations in Ukraine.

According to recent congressional testimony from one of the partners, the Hunter Biden-affiliated Burnham entity was set to receive a quarter of the new venture’s net revenues without any cash investment.

The Ukrainian oligarch Zlochevsky committed “$120 million over thirty-six (36) months to be invested in exploration and leasehold improvements” in the new venture, aimed at making Burisma a global energy leader, as per the project’s prospectus.

An August 2015 email from Zlochevsky’s top lieutenant, Vadym Pozharskyi, emphasized the importance of Hunter Biden’s involvement with Burnham Energy for his boss.

“You mentioned to me that it’s also you and HB [Hunter Biden] who will be the founders of the Llc in Delaware. Cliff mentioned only yourself,” Pozharskyi wrote Archer in August 2015 in one email obtained by Just the News. “For credibility ‘Ukrainian’ purposes you both would be better.”

It remains unclear what exactly Vadym Pozharskyi meant by “credibility,” but previous reports have indicated that Burisma viewed Hunter Biden’s presence on its board as a protective measure against government pressure. This perspective was supported by Devon Archer’s testimony during the House impeachment inquiry.

Another partner, Jason Galanis, testified to Congress that he believed Archer and Biden were placed on the board to shield the company from Ukrainian investigations and prosecutions.

Pozharskyi also directly communicated with Hunter Biden about the new venture. In an email dated August 12, 2015, he wrote to Biden and Archer: “Burnham Energy Security Fund: we started a legal discussion between our lawyers and legal counsels from your side (through Devon’s kind introduction). At the moment, we’re working on structure and all related issues.”

This email was sent just a few months after Joe Biden met with Pozharskyi and other foreign business partners of Hunter Biden at a dinner at Cafe Milano in Washington, D.C., in April 2015, according to evidence released by Congress during the Joe Biden impeachment inquiry.

Among the evidence gathered by the FBI in 2016, nearly 200 documents mentioned Burnham Energy Security LLC (BESL), with most referencing Hunter Biden or his role at the parent firm, Burnham Asset Management (BAM).

“What’s a current role of HB [Hunter Biden] in BAM and what role he’ll have in BESL?” a top official working for Zlochevsky’s firm asked in an Aug. 25, 2015, email

“HB is a W-2 employee of BAM and the Vice-Chairman of the parent company which owns 100% of BAM. HB is also contemplated as a director of BESL,” a lawyer drafting the deal wrote back.

Evidence revealed that lawyers in the United States and Ukraine were finalizing a term sheet for the venture in September 2015 when Hunter Biden’s team encountered two major setbacks within 24 hours.

First, on September 24, 2015, Hunter Biden’s business associate, Jason Galanis, was arrested in a securities fraud case. Later that same day, U.S. Ambassador to Ukraine Geoffrey Pyatt delivered a speech urging Ukrainian prosecutors to pursue corruption charges against Burisma’s owner, Mykola Zlochevsky, after months of inaction.

Pyatt’s speech posed a significant problem for Biden, Archer, and Burisma. In response, they quickly hired Blue Star Strategies, a U.S. lobbying and public relations firm with Democratic ties, to manage the fallout and lobby U.S. officials in the Obama-Biden State Department to dismiss any Ukrainian corruption allegations against Burisma.

A month after Pyatt’s speech, Burisma officials drafted a wish list of statements they hoped Pyatt would be compelled to make as damage control regarding Zlochevsky, referred to in the emails by his initials “NZ.”

“Target: Us ambassador communicates to Ukraine officials I.e. President administration formally/informally that he/U.S. government is ok with NZ, supports him and Burisma,” one email summarizing Burisma’s wish list read. “Other U.S. High ranking officials communicate this message to President Administration. President Administration and other agencies ( general prosecutors office ) do not pursue NZ. NZ freely travels home. Ambassador Pyatt loves NZ.”

Archer, Hunter Biden’s close associate at the time, thought that request might be too much given how harshly Pyatt had criticized Zlochevsky in his speech a few weeks earlier.

“I think this might be a little too overt but this was the feedback below,” Archer wrote a Blue Star executive in October 2015. “Anyway to tone down but in operate [sic] would be useful.”

Pyatt’s speech unexpectedly kicked Ukrainian prosecutors into a more aggressive effort to investigate Zlochevsky in fall 2015, an effort that came to an abrupt halt when Vice President Joe Biden pressured Ukraine to fire the chief prosecutor, Viktor Shokin, by threatening to withhold $1 billion in U.S. loan guarantees. Archer told Congress last year that Burisma wanted Hunter Biden to get help from “D.C.” to deal with the pressure from the Shokin probe.

The Yuzivska Block

There is no evidence the Burnham Energy Security deal got resurrected after the tumultuous events of fall 2015. But a series of drafts of the term sheet for the proposed venture details the primary goals of the partnership between the Burnham group and the Ukrainian oligarch: expanding Burisma’s energy production both inside and outside of Ukraine.

Burnham Energy Security would be a “vehicle to acquire the rights to explore and recover hydrocarbons within the Yuzivska Block of the State of Ukraine, with the intention of scaling and expanding exploration and recovery to Mexico, Kazakhstan and other locations,” reads the term sheet obtained and reviewed by Just the News. Importantly, the new firm would be used for “all expansion bidding” on Burisma’s behalf globally.

The Yuzivska Block, the natural gas field in Eastern Ukraine referenced in the sheet, is near the region in Ukraine that was under threat from Russian-backed separatists at the time. Those separatist groups in the far east of the country had declared independence from the central government in Kyiv as a result of the Revolution of Dignity, or Maidan Revolution, in 2014 which brought the central government closer to the West. That same year saw the Royal Dutch Shell Corp. withdraw from a gas exploration project in gas field citing geopolitical concerns, opening the market for Burisma.

Hunter Biden—who was serving as a board member of Burisma at the time—is not mentioned in the term sheet, which lists Devon Archer as the director of the proposed entity.

However, email communications between lawyers responsible for hammering out the deal show the group was considering Hunter Biden to be a director of the enterprise along with fellow Burisma board member and former Polish President Alexander Kwasnieski.

The Liechtenstein Factor

The joint venture envisioned establishing an entity in the small European country of Liechtenstein. It is unclear exactly why, however, the country does boast significant tax benefits, including no capital gains taxes.

The partners may have also wished to obscure the direct relationship with Burisma owner Zlochevsky. At the time, the oligarch’s public reputation had taken hits after his assets were frozen in the United Kingdom beginning in 2014. After Ukrainian authorities refused to cooperate with the British probe and Zlochevsky’s accounts were unfrozen, a Ukrainian deputy prosecutor came forward to allege the Burisma owner had bribed the Ukrainian authorities.

“We consider three of jurisdictions [sic] in order to incorporate a fund: USA, Lichtenstein [sic] and Luxembourg. We inclined [sic] to Lichtenstein [sic], that uses [sic] commonly for such purposes as we need to achieve,” the Ukrainian side wrote in an August 2015 email.

“Lichtenstein [sic] is the preferred jurisdiction for the entity” and “The best structure for the intended purpose is a Lichtenstein [sic] limited liability company (LLC, Ltd.),” the American side replied.

The documents and emails do not make clear whether or not Hunter Biden or his partners stood to directly benefit from the arrangement. But the term sheet outlines that net revenue from the venture would be distributed between Zlochevsky’s company (75%) and the Burnham Asset Management branch headquartered in the United Kingdom (25%).

Trading on the Biden name and connections

What Hunter Biden and Devon Archer were up to is clearer, however, based on the testimony of an ex-partner and emails obtained from the laptop. Galanis testified that he worked with Archer and Biden to build the Burnham group into a global, multibillion-dollar hedge fund marrying foreign investors with the “globally known political name” Biden.

The plan focused on building global cooperation between prominent investors from all continents, including deals with high-powered oligarchs from Russia and Kazakhstan, Chinese government-linked businessmen, and politically connected Mexican tycoons, among others, Just the News previously reported.

The first event which spelled trouble for the proposed venture was the arrest of Galanis.

In his testimony to Congress earlier this year, Galanis explicitly mentioned this proposed Burisma investment in Burnham and how his arrest and subsequent conviction related to it.

“Burnham also reached an agreement with a Ukrainian oligarch, Mykola Zlochevsky, for a $120 million investment into a new Burnham entity. The financial arrangement documented by the U.S. and Ukrainian lawyers laid out a 25 percent profit participation for the Burnham partners,” Galanis told the impeachment inquiry.

“The Burnham partners were not required to put up 25% of the capital. Instead, Burnham was putting up the relationship capital of the Biden name in foreign markets like Kazakhstan and Mexico and elsewhere where oil concessions were sought from government,” he added. Galanis testified the venture was set to begin with pursuing a production sharing agreement to take over the gas field from the Shell oil company in Eastern Ukraine.

But, the fund was unusual. The Burnham side, made up of Hunter Biden and his business partners, would not have to put up any of the initial investment. Instead, Galanis testified, their contribution was relationship capital–including the political connections that are associated with the Biden family name.

“Mykola would put up all the money. We, Burnham, would put up the investment banking expertise and the political connects and influence in foreign countries where we were seeking oil and gas leases,” Galanis told Congress.

In one email, Galanis makes explicitly clear that Archer and Biden were also offering “nonlegal” protection to Zlochevsky, its main investor.

“At the end of the day, the other non legal protection is the relationship cover of DA and HB,” Galanis wrote in late August 2015.

The plan eventually collapsed when a fraudulent tribal bonds scheme led to the downfall of Jason Galanis in September of that year. Devon Archer was also implicated in the case and both were ultimately convicted for their roles in the scheme. Archer appealed his conviction, which was initially overturned, then reinstated. Archer eventually appealed to the Supreme Court, which affirmed the conviction.

Recently, a federal judge ordered Archer to be resentenced after his original one-year prison sentence. Archer argued that a sentencing guidelines calculation error warranted reconsideration due to “ineffective assistance of counsel.”

Hunter Biden was not charged in the scheme. However, Galanis told Congress that the tribal bonds scheme was executed to raise funds for the Burnham enterprises, in which Hunter Biden was involved.

“In an effort to build this financial platform, I engaged in unlawful conduct. Our companies were entrusted with $11 billion of union members’ pension fund money, whose trust I betrayed. I pleaded guilty, and I had 8 years in federal custody to reflect on my actions, and I’m profoundly sorry for my role in these actions,” Galanis told congressional investigators in his opening statement.

SOURCE: JUSTTHENEWS

You may like

Biden Crime Family

FBI Silenced Analyst Who Told Twitter Hunter Biden Laptop Story Was Real

Published

8 months agoon

April 3, 2025

Newly released chat logs reveal that the FBI silenced an employee who attempted to confirm to Twitter that the Hunter Biden laptop story was legitimate on the day it was published. On October 14, 2020, the same day The New York Post first reported on Hunter Biden’s laptop, the FBI instructed employees, “do not discuss [the] Biden matter,” according to chat logs released by the House Judiciary Committee. The logs also indicate that an analyst who confirmed the laptop’s authenticity to Twitter during a meeting was subsequently subjected to a “gag order” and reprimanded by FBI officials.

Laura Dehmlow, an FBI official with the bureau’s foreign influence task force, previously testified that during the call with Twitter, an analyst confirmed the laptop was real before an FBI attorney stated the bureau would not comment further. The chat logs show internal discussions within the FBI on how to handle the situation, with messages reiterating the directive not to discuss the laptop.

Following the meeting, the analyst was “admonished” for speaking up, and one FBI staffer complained that the analyst “won’t [sic] shut up” as instructed. The FBI declined to comment on the matter. The bureau had already verified the laptop in late 2019 by cross-referencing the device’s serial number with Biden’s iCloud storage, according to FBI Special Agent Erica Jensen’s testimony during Hunter Biden’s gun trial last year. Federal agents obtained data from the laptop after securing a search warrant as part of an ongoing criminal investigation into Biden’s tax affairs.

IRS whistleblower Gary Shapley provided a similar account to Congress in 2023, alleging misconduct by IRS and DOJ officials in the investigation. Independent journalists Catherine Herridge and Michael Shellenberger first reported on the chat logs. Herridge has claimed that she was prevented from reporting on the laptop ahead of the 2020 election during her tenure at CBS News. Both Twitter and Facebook censored The New York Post’s reporting on the laptop after the FBI and other government agencies spent nearly a year preparing social media platforms to suppress the story.

Attorney General Pam Bondi later disbanded the foreign influence task force, which had played a role in coordinating content moderation efforts. House Republicans on the Judiciary Committee and the Weaponization Subcommittee have been investigating the suppression of the laptop story and other instances of political censorship.

Judiciary Committee Chairman Jim Jordan (R-Ohio) has been vocal in opposing social media companies working with the government to restrict certain viewpoints. Last year, Meta CEO Mark Zuckerberg acknowledged that Facebook was wrong to suppress the Post’s reporting and criticized the Biden administration for pressuring the platform to censor certain discussions related to COVID-19.

Twitter, now rebranded as X, was acquired by Elon Musk in late 2022. Following the acquisition, Musk authorized the release of the “Twitter Files,” which detailed how company executives decided to censor the laptop story and limit the reach of conservative accounts. In December, then-President Joe Biden pardoned his son before his sentencing for federal gun and tax charges. Hunter Biden had been convicted on gun-related charges in Delaware and pleaded guilty to tax violations in California.

Hunter Biden’s foreign business dealings, along with the IRS whistleblower allegations, were central to the House GOP’s impeachment inquiry into Joe Biden. The investigation uncovered over $27 million in payments from foreign sources to Hunter Biden and his associates during and after Joe Biden’s tenure as vice president.

The inquiry also documented instances where Joe Biden met with his son’s business partners and joined them on speakerphone approximately 20 times. The Trump administration recently promoted Shapley and IRS whistleblower Joseph Ziegler to senior adviser positions after they faced alleged retaliation within the IRS.

Additionally, former President Trump granted clemency to two of Hunter Biden’s business associates, Devon Archer and Jason Galanis, both of whom testified during the impeachment proceedings.

SOURCE: NATIONAL REVIEW

Biden Crime Family

Biden Administration Lost Track of Billions in Seized Crypto

Published

9 months agoon

February 22, 2025

The U.S. Marshals Service (USMS) cannot confirm how much bitcoin it holds. It is also struggling with serious organizational issues. The agency has attempted to address these problems through procurement, but the process has dragged on for years.

The USMS is responsible for managing assets seized during criminal investigations, including real estate, cash, jewelry, antiques, and vehicles. It is also tasked with handling cryptocurrencies—such as the billions of dollars worth of bitcoin (BTC) the FBI seized from the darknet marketplace Silk Road in 2013.

The USMS’s Uncertainty Over Its Crypto Holdings

Despite its role in managing seized digital assets, the USMS doesn’t seem to know how much cryptocurrency it currently holds. In fact, it is struggling to even estimate its bitcoin holdings, a source familiar with the matter told CoinDesk.

This uncertainty could be a major issue, especially after White House Crypto Czar David Sacks announced earlier this month that the U.S. government is actively exploring the creation of a national crypto reserve. If this plan moves forward, the government may stop liquidating seized cryptocurrencies and could even start purchasing crypto.

“When you start talking about reserves, you need to be familiar with the unique properties of the assets, like forks, airdrops, and the constant volatility,” said Les Borsai, co-founder of Wave Digital Assets, a firm that provides asset management services and has been in a dispute with the USMS over not getting hired as a contractor. “You have to have the agencies educated enough or dealing with professionals that understand how to help them achieve their goals.”

Even if the crypto reserve never materializes, the USMS still plays a crucial role in managing and liquidating seized digital assets—especially since asset forfeiture helps fund the Department of Justice (DOJ).

“As far as I’m aware, the USMS is currently managing this with individual keystrokes in an Excel spreadsheet,” said Chip Borman, vice president of capture strategy and proposals at Addx Corporation, a firm that provides technological solutions to the U.S. government and was also turned down for a USMS contract. Borman said he observed USMS processes firsthand in 2023.

“They’re one bad day away from a billion-dollar mistake.”

USMS’s Troubled History With Crypto Management

Issues with the agency’s handling of cryptocurrency aren’t new. Timothy Clarke, CEO of crypto consulting firm ECC Solutions and a former special agent at the Department of Treasury, told CoinDesk that frustration has been building for years in both the public and private sectors.

As recently as 2019, the USMS “only handled a handful of cryptocurrency assets, like eight or 10, so all the different U.S. government agencies had to do their own storage, instead of the USMS doing its job and intaking seizures,” Clarke said.

He also noted that when agencies requested bitcoin deposit addresses after making a seizure, the USMS took weeks to provide them—and even then, it simply sent them via unencrypted email without any verification process.

By contrast, agencies like IRS Criminal Investigation (IRS-CI) communicate such sensitive information through video calls, read-only encrypted attachments with password-protected follow-ups, or in-person handling by specialists.

“It was very, very unsecure,” Clarke said. “It’s just shocking that nothing happened in the years they did that.”

The USMS declined to comment.

In 2022, the Office of the Inspector General (OIG) warned that the USMS was struggling with the management and tracking of its cryptocurrency holdings.

“The USMS did not have adequate policies related to seized cryptocurrency storage, quantification, valuation, and disposal, and in some instances, guidance was conflicting,” the OIG report stated.

For example, the agency had no measures in place to track forked assets—cryptocurrencies created when a blockchain splits, like Bitcoin Cash (BCH) or Bitcoin Satoshi Vision (BSV). “As a result, the USMS may fail to identify and track forked assets, and thereby lose the opportunity to sell those assets when they are forfeited,” the OIG said.

The spreadsheets the agency relied on to track crypto holdings also contained inaccuracies, the report found.

In November 2022, five months after the OIG report was published, the USMS admitted it had lost access to two Ethereum wallets due to a software update.

“It is unclear if the private key is incorrect, or the wallet malfunctioned,” the agency stated. “The Contractor will identify the issue(s) and potentially open the wallet. If the wallet cannot be opened, documentation of efforts taken to unlock or open the wallet will be provided to the USG.”

Clarke said it was unclear whether the issues with the Ethereum wallets had occurred before, during, or after the OIG audit, as the report made no mention of missing ether (ETH).

“At a minimum, it speaks to a lack of a backup wallet and a lack of competent storage, update, and handling procedures,” Clarke said.

“The perception is that everything has remained the same since the 2022 OIG Findings,” said John Millward, chief operating officer at Addx.

Millward claimed that a single employee is currently managing asset disposal “right now on a retail account,” despite the massive financial responsibilities involved. However, the agency has not confirmed this.

Liquidating Crypto Ahead of a Possible Stockpile

In July 2024, at a Bitcoin conference in Nashville, President Trump stated that, if reelected, he would order the federal government to stop selling seized bitcoin. The idea had been championed by Senator Cynthia Lummis (R-WY), one of bitcoin’s strongest supporters in Congress, who introduced legislation to establish a national bitcoin reserve.

On Jan. 15, just days before Trump was set to take office, Lummis wrote to then-USMS Director Ronald L. Davis, expressing concern that DOJ attorneys were rushing to liquidate 69,370 bitcoin (worth about $6.6 billion) seized from Silk Road.

“Recent court filings from earlier this month show that the Department of Justice is citing bitcoin price volatility to justify an expedited sale of these assets,” she wrote.

She also noted that the DOJ was pushing ahead with liquidation plans despite pending legal challenges, calling it an “unusual urgency” that contradicted the incoming administration’s plans for a national bitcoin stockpile.

Lummis requested details on the USMS’s bitcoin holdings, why the information wasn’t publicly available, and how the agency tracks and manages its assets. The agency was given until Jan. 31 to respond but has yet to do so, according to a source familiar with the matter.

The USMS has since contacted Lummis’ office twice but was unable to provide a clear answer on how much bitcoin it controls, blaming the transition between administrations. Lummis’ office declined to comment.

According to sources, large amounts of bitcoin are being held across multiple government agencies, including the DOJ and the Department of Treasury, and the USMS lacks a reconciliation process to determine where it all resides.

USMS’s Procurement Struggles

In 2022, the OIG acknowledged that the USMS was taking steps to improve its asset management by partnering with private-sector firms. However, the agency has been slow to award contracts, and its decisions have been controversial.

After procurement efforts began in 2018, the agency awarded a contract to Bitgo in April 2021, but later revoked it because the company didn’t meet the “small business” requirement. The award then went to Anchorage Digital in July 2021—only for Anchorage to be disqualified for the same reason.

In 2024, the USMS awarded two new contracts: one to Coinbase for managing “Class 1” cryptocurrencies (widely supported coins) and another to Command Services & Support (CMDSS) for “Class 2-4” cryptocurrencies (less common assets).

Both awards have faced legal challenges. Anchorage protested Coinbase’s contract, while Wave Digital Assets is challenging CMDSS’s award, arguing that the company lacks the necessary SEC and FINRA licensing and that it hired a former USMS official with access to nonpublic information.

Borsai was blunt in his assessment:

“If you don’t care about the basics, like being licensed to handle securities, then what are you doing? It just shows you how little they know about the process.”

SOURCE: COINDESK

Biden Crime Family

Justice Department Finds Transcripts They Previously Denied Existence of in Biden Classified Material Investigation

Published

1 year agoon

July 23, 2024

In a significant development, the Justice Department revealed to a federal judge late Monday that it possesses transcripts of President Joe Biden’s conversations with a biographer, contradicting earlier denials. These transcripts are related to the recently concluded criminal investigation into Biden’s handling of classified materials before he became president.

The special counsel, Robert Hur, issued a report in February describing Biden as “a well-meaning, elderly man with a poor memory.” This report has prompted a surge of Freedom of Information Act (FOIA) requests and lawsuits aimed at obtaining records related to Hur’s investigation. These requests have come from various news outlets and conservative groups seeking to scrutinize Biden’s mental acuity and fitness for the presidency.

Concerns about Biden’s cognitive abilities were exacerbated by a poor debate performance against Donald Trump, leading Biden to announce on Sunday that he would not seek reelection. It remains unclear how his exit from the race will affect the Justice Department’s handling of the materials from Hur’s investigation.

The Justice Department has argued that releasing the audio of Biden’s interviews would violate his privacy, potentially lead to abuses like deepfakes, and discourage other witnesses from agreeing to recorded interviews. Biden has asserted executive privilege over these recordings to prevent House Republicans from holding Attorney General Merrick Garland in contempt of Congress for refusing to release them.

During a hearing last month, DOJ lawyers informed U.S. District Judge Dabney Friedrich that processing the audio files of Biden’s interviews with writer Mark Zwonitzer would be highly time-consuming. They claimed that the recordings spanned 70 hours and reviewing audio for classified material is more challenging than reviewing written material.

Justice Department lawyer Cameron Silverberg stated at a June 18 hearing that no transcripts from the special counsel existed. However, Silverberg’s recent court filing revealed that the DOJ had found six electronic files, consisting of 117 pages of verbatim transcripts, created by a court-reporting service from Biden’s discussions with Zwonitzer. Some of these conversations contained classified information, but DOJ policy barred pursuing charges against a sitting president.

In an unexpected reversal, the Justice Department reached out to Robert Hur directly after initially resisting requests from the Heritage Foundation to contact him about materials he used for his report. Hur confirmed he relied on the Biden-Zwonitzer audio recordings and a portion of Biden’s handwritten notes regarding a memo about Afghanistan.

Judge Friedrich has scheduled a hearing for Tuesday morning to address these developments. The Justice Department has indicated it will discuss with the parties seeking access to Hur’s materials whether Biden’s notes should also be processed for potential release.

The Justice Department’s admission of the existence of transcripts in the Biden classified material investigation marks a crucial turn in the ongoing scrutiny of Biden’s handling of classified information. As legal proceedings continue, the implications for transparency, presidential privacy, and the political landscape remain to be seen.

SOURCE: POLITICO

Tim Walz asked Minnesota assassin to kill Senator Klobuchar so he could take seat, FBI letter claims

ChatGPT use linked to cognitive decline, MIT research finds

Kamala Harris Allegedly Covered Up Biden’s Mental Decline, Democratic Source Says

Biden Administration Lost Track of Billions in Seized Crypto

Tim Walz asked Minnesota assassin to kill Senator Klobuchar so he could take seat, FBI letter claims

You must be logged in to post a comment Login